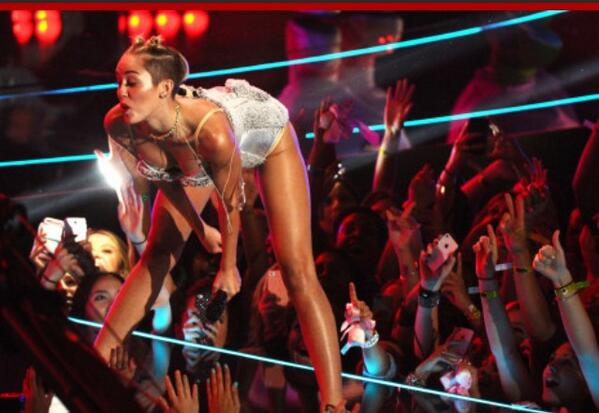

image: Reuters/Mike Segar

Lately Rand Paul has been churning out almost as many bizarre scandals as our beloved Mayor Rob Ford. The only difference is that, while Rob Ford does stupid things, Rand Paul says stupid things. And these things are not only stupid, but in many instances dangerous and awful. In fact, it is truly worrying that any elected official should go around propagating such hateful crap.

Paul’s latest incident occurred yesterday when he was caught summarizing the plot of Gattaca in a speech using words taken pretty much ad verbatim from Wikipedia. And, honestly, even if I had stopped that sentence at “speech,” it still would have been weird! (He was trying to make the point that a future with legal abortion and scientific breakthroughs will lead to the widespread practice of eugenics. In case that wasn’t obvious.)

One of Paul’s pet projects is a holdover from his father, former Representative Ron Paul, which is catchily named “Audit the Fed.” Actually, Ron Paul also wants to reinstate the gold standard and stop the theft that is inflation, but junior is taking a more moderate position, which apparently entails refusing to vote in favour of Janet Yellen as Chair of the Fed unless Congress also votes on a bill that would provide more oversight of the Fed. That nasty, scheming Fed.

Actually, I will grant him that. It has always puzzled me that an unelected entity has so much power over something so important. Though this is separate from the issue of lack of oversight at the Fed, which I personally don’t think is a problem. But we half agree on something, so that’s kind of a thing. I also didn’t mind his filibuster against drone strikes on Americans on American soil. Ok, fair enough.

However, one of the things I cannot accept is his relentless fear-mongering about an impending WAR between Muslim and Christian countries. In a speech at the Value Voters summit, Paul used his time to warn Americans about the impending war on Christianity that will be perpetrated by Muslim extremists, the numbers of whom he estimates at around 100 million. Leaving aside the fact that he makes no mention of how he arrived at this number, where is the evidence of this Muslim conspiracy against Christianity?

Ugh.

Well, the Boston Marathon bombing, for starters. Duh. An attack by two Chechen Muslims on athletes from 90 countries is undeniable proof of a vast, looming Muslim invasion of America. It doesn’t matter that, as Dean Obeidallah rightly points out in his article in the Daily Beast, that if this had anything to do with Christianity, they would probably have struck one of Boston’s numerous churches. Also, why did they choose one of the more internationally flavoured events for their attack? Nope, replies Rand, a strike on American soil is a strike against America, and, therefore, against Christianity. Hm….so I am beginning to understand.

America = Christianity

100 million Muslims = extremist

1.6 billion Muslims in the world

Therefore:

6.25% of the world’s Muslims are raring to battle the Christian Empire of America. That’s more than one in 20. I’m pretty sure that one in 20 Muslims have more important things to worry about than destructing Christianity. But I could be wrong.

In any case I don’t understand what he’s so worried about–according to most sources, around 80% of the Americans identifiy as Christian, which adds up to around 246 million people. So for every one Muslim extremist, there are 2.5 righteous American Christians. Outnumbered! Phew.

But wait. What kind of stupid idiot would show up for Paul’s war against 100 million nonexistent jihadists? Surely not all the Christians in America are that dumb. And sure enough, according to a poll that I just made up in my head just now, a mere 8% of America’s Christians would show up for the fictitious war. Oh shit–now they are outnumbered. Good thing the 100 million extremists are imaginary.

Yes, jihadists exist. Hundreds of millions of them do not, and most Muslims are as worried about them as Rand Paul is. Warmongering is not a good way to deal with religious differences, as all of history forever and ever has taught us. In fact, it is exactly this exclusionary, us-against-them attitude that contributed to the alienation of the Boston bombers from American society. (Though what they did is obviously unjustifiable.) I would argue that the isolating effect of America’s gradual slide toward a less communal, more every-(wo)man-for-himself society played a way bigger role in this whole thing than religion. And if Mr Paul is the best America has to offer, then they’re going to have to treat their immigrants (and citizens) better–they’ll need them!

(NB: Sorry Americans. I know there are a lot of smart ones of you out there; I’m not talking about you.)

…but is following a trajectory similar to that of Canada. I presume that the Fed would prefer a slightly higher rate–1.1% is lower than it’s been in recent years and the QE continues, albeit amid rumours that it will be tapered off at the end of the summer.

…but is following a trajectory similar to that of Canada. I presume that the Fed would prefer a slightly higher rate–1.1% is lower than it’s been in recent years and the QE continues, albeit amid rumours that it will be tapered off at the end of the summer.